Singapore’s property market saw significant increases in 2024, with average HDB flat prices reaching $532,768 and private houses averaging $2,080,533. Rental costs also rose, with the average now around $2,600 per month.

Singapore residents enjoy a higher quality of life than many other nations, with low crime rates, high employment, robust economy, and excellent infrastructure. Annual income has increased by over 40% in the past decade, offsetting some of the higher living costs.

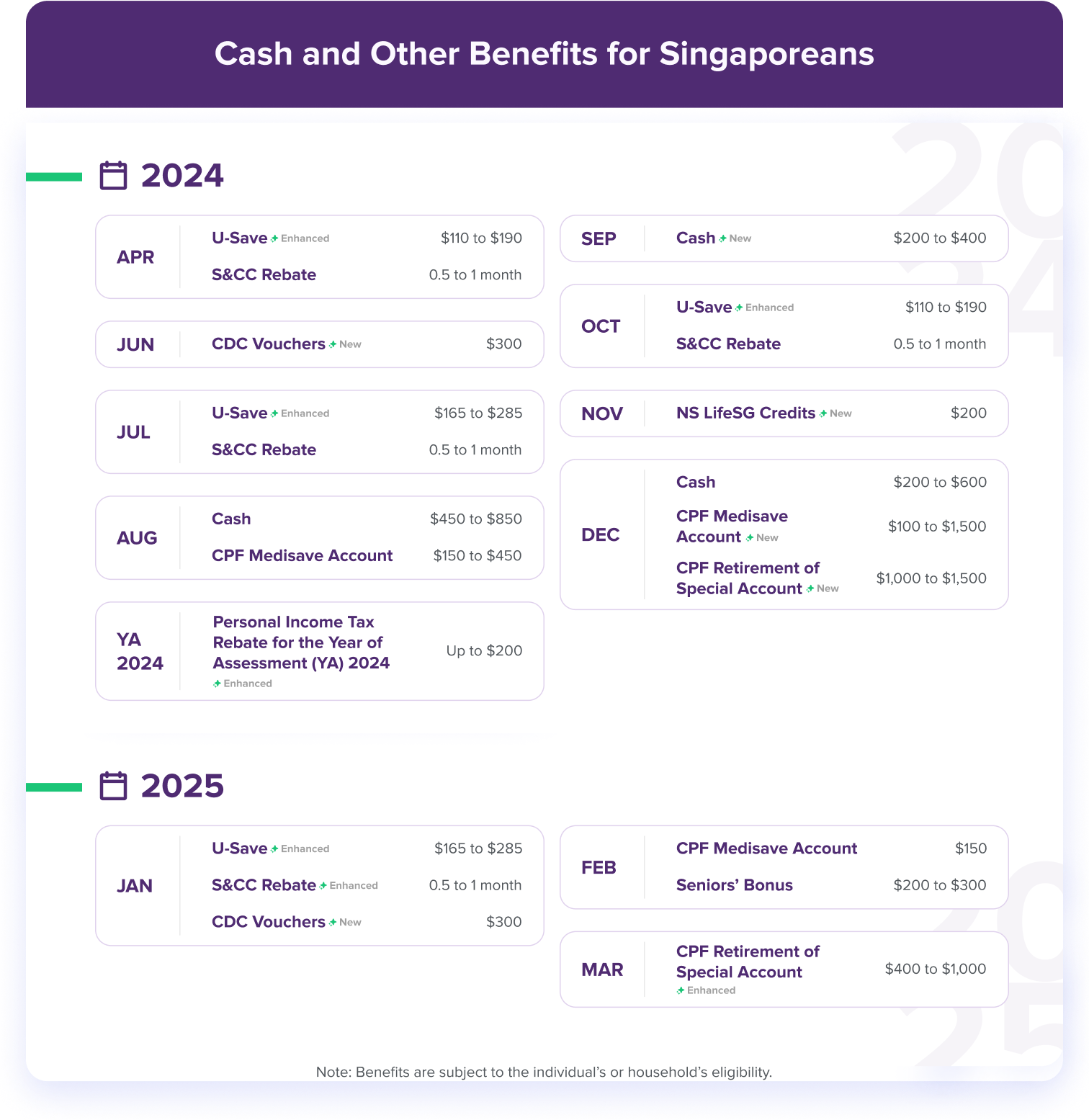

The Singapore government has announced increased support, including an expanded Assistance Package with cash payments for eligible adults. A $1.1 billion Cost-of-Living support package has also been unveiled to help citizens cope with economic pressures.

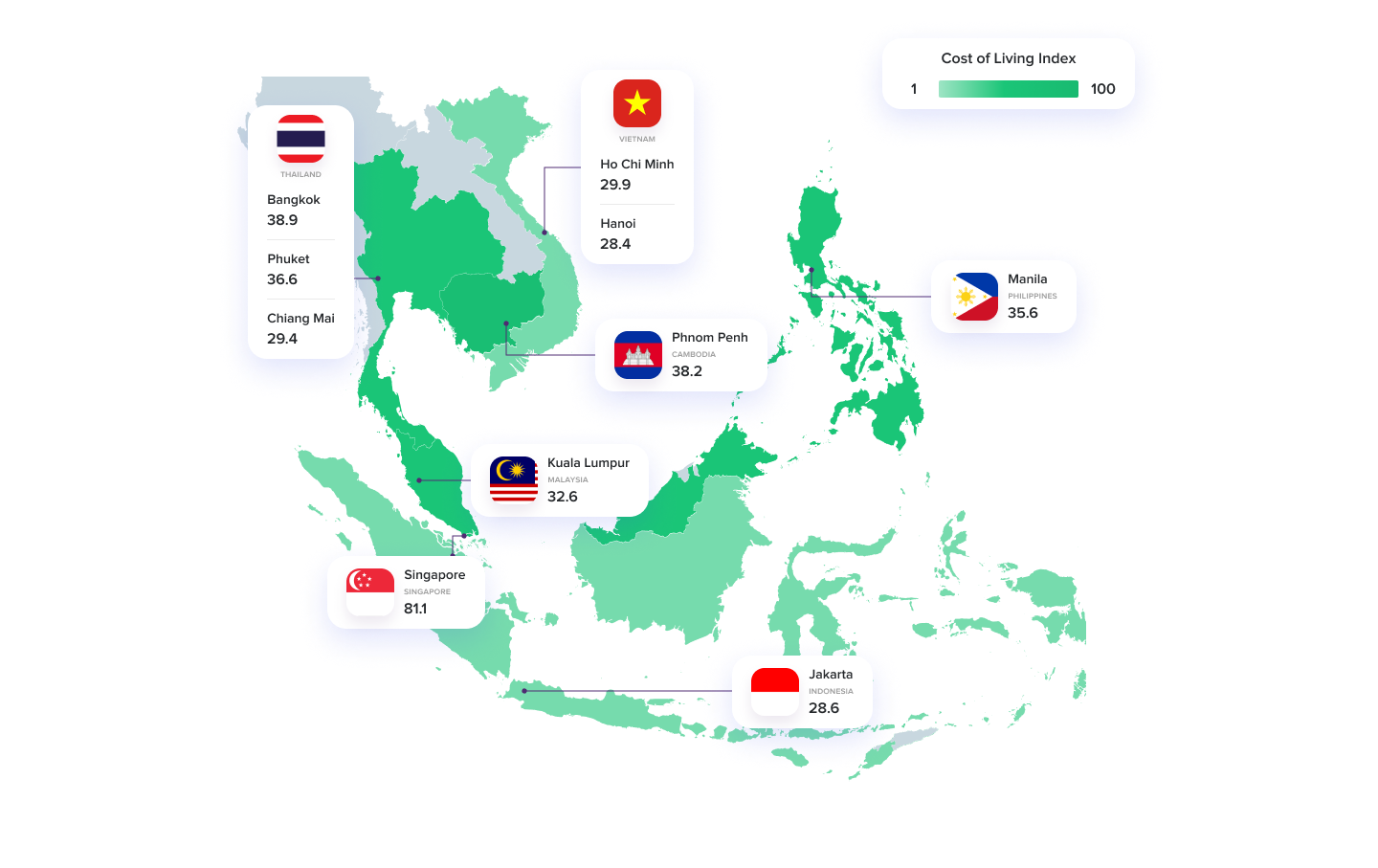

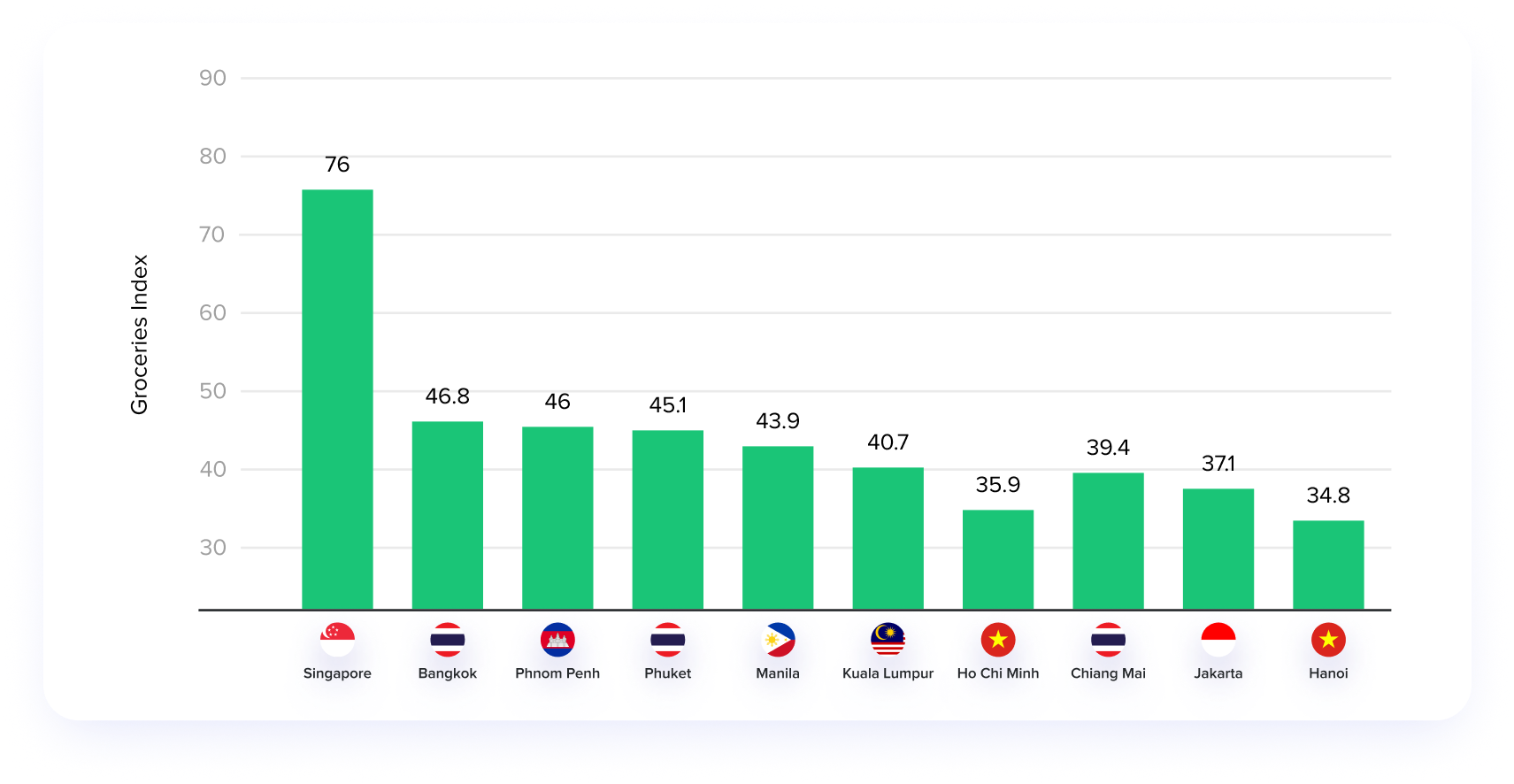

Southeast Asia shows significant variation in living costs across countries. Singapore leads with the highest cost of living index at 85.9, far exceeding other nations in the region. This high cost is due to several factors: Singapore's limited land and advanced infrastructure, robust economy, high wages, strong currency, and its status as a global financial hub attracting multinational corporations and wealthy expatriates. Additionally, Singapore's stringent import regulations and high-quality education and healthcare systems contribute to elevated living expenses. In contrast, Indonesia presents the lowest index at 31.2, followed closely by the Philippines at 34.0.

The remaining nations fall between these extremes. Thailand and Cambodia show relatively higher indices at 40.7 and 44.5 respectively, while Vietnam and Malaysia demonstrate moderate living costs with indices of 35.7 and 35.0. These figures provide valuable insights into the economic landscape of Southeast Asia, offering a comparative view of expenses across the region. It is important to note that cost of living does not directly correlate with quality of life, as many factors contribute to overall living standards in each country.

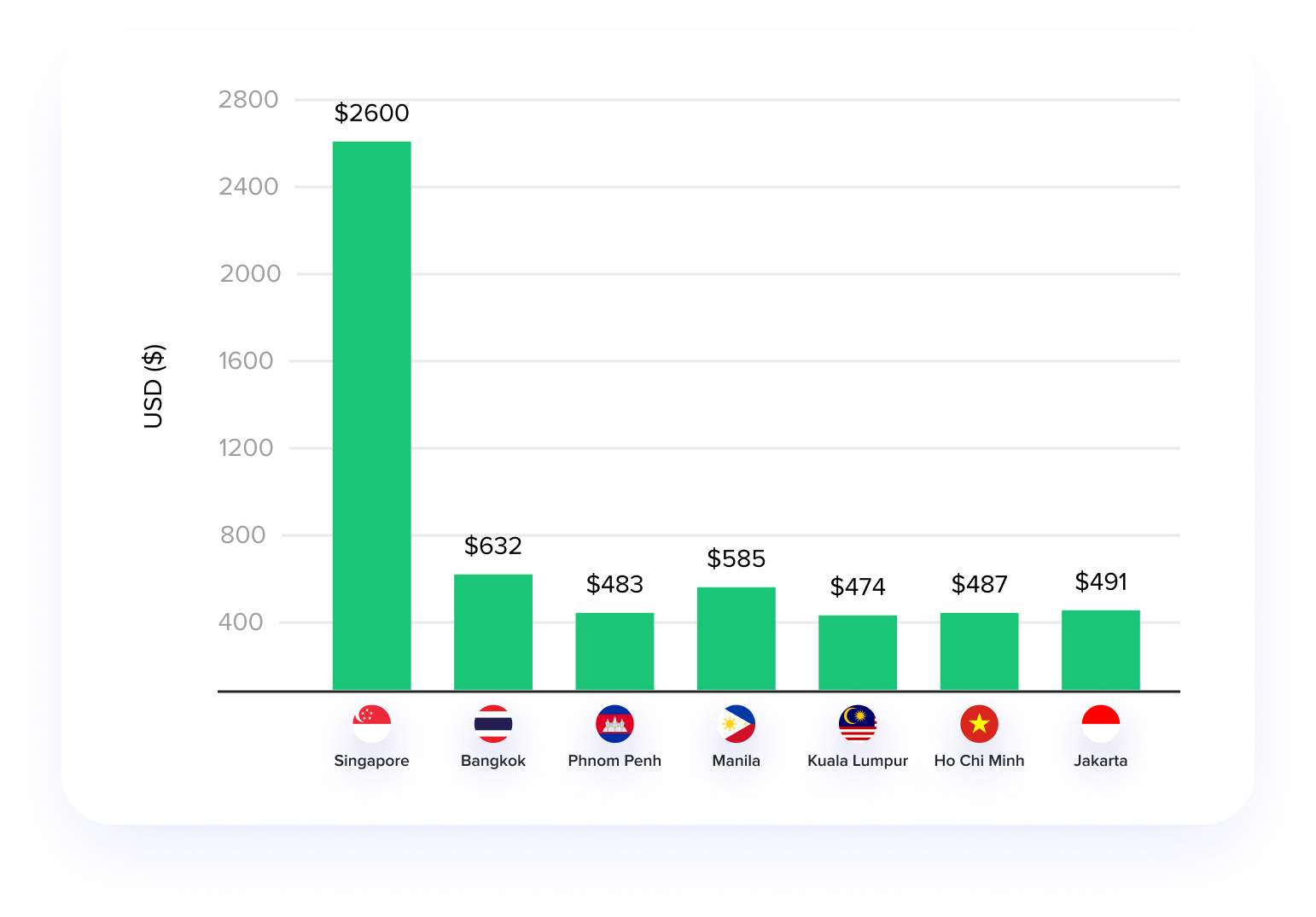

Without a doubt, the most significant trend in Singapore is the country’s rising property and rental rates, which saw a stark increase in 2024. Of course, the precise cost of housing varies widely based on the housing type and size of your family.

For example, the average cost of an HBD flat in 2024 was reported to be around $532,768, which is the cheapest option for anyone looking to own a property. On the higher end, houses in Singapore currently average around $2,080,533, and condos at $1,100,000.

In terms of rental properties, tenants are also expected to feel the impact of a higher cost of living. Reports indicate that renting a home in Singapore currently costs around $2,600. However, this may be lower for adults looking to rent an apartment or condo in a less expensive location. In contrast, cities like Bangkok, Thailand, offer more affordable housing options with the average cost of renting an apartment in the city centre being around $700 per month.

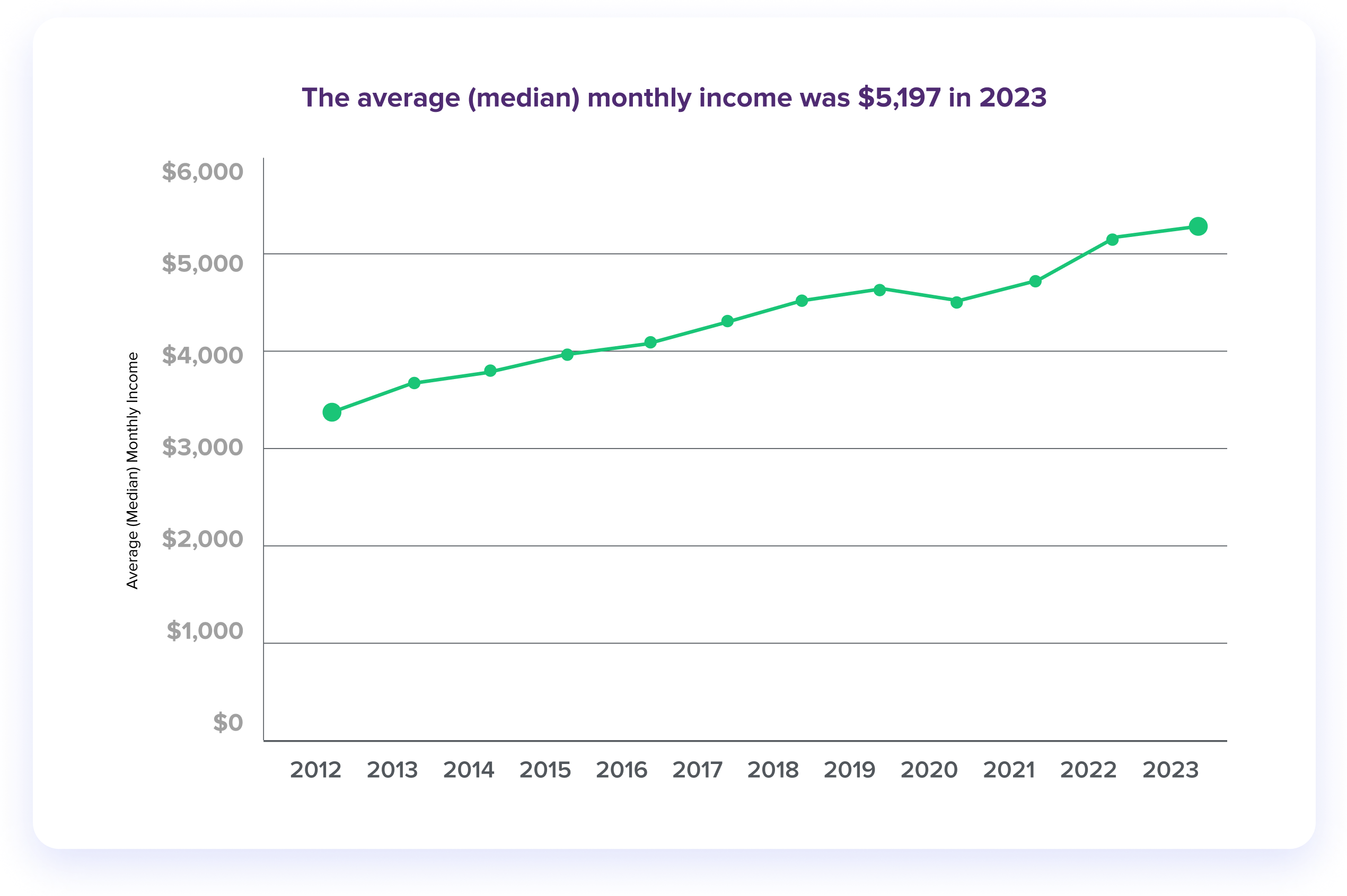

Despite the increased cost of living, Singapore residents continue to enjoy a higher quality of life than other nations. Some of the factors driving Singapore’s high living standards include the country’s historically low crime rates, high employment and salary rates, robust economy, and excellent infrastructure.

In fact, Singapore residents earn more money now than ever before. Over the past decade, the annual income in the country has increased by more than 40%, which is a sharp contrast to other countries whose salary range has not increased alongside the living cost.

While the cost of living may seem extreme to outsiders, Singapore locals know that these costs are simply a reflection of the country’s elite quality of life, which has consistently ranked highly among global indexes. Other high-cost cities like Hong Kong and Seoul also reflect similar trends, where residents benefit from high incomes and exceptional quality of life, albeit at a high financial cost.

With that in mind, it should be no surprise that more families are choosing to start the next chapter of their lives in Singapore. In 2024, the country’s population density increased to unprecedented levels, leading to a surge in pricing for amenities and resources. Similarly, in Ho Chi Minh City, Vietnam, there has been a notable increase in the number of families relocating as a result of the vastly growing economy and improved living standards.

As Singapore is an island nation, many of these resources are imported from mainland providers. This spike in population has created an intensely competitive environment for providers, resulting in even higher costs for residents.

Additionally, more residents have been a contributing factor in increasing housing and utility costs, making it essential for locals to have access to reliable loan providers when searching for quality housing options.

One of the top reasons for Singapore’s high quality of life is the country’s exceptional healthcare, which is widely regarded as one of the most efficient healthcare systems in the world, especially in a post-pandemic landscape.

That said, maintaining such a high quality of care also leads to higher costs, and Singapore residents can anticipate higher insurance premiums in the coming years. According to MediShield Life, premiums have increased by 35.4% since 2021. This is caused by many factors, including residents' longer life expectancies and a higher demand for medical services.

The cost of healthcare in Bangkok has also risen as a result of improved healthcare services and increased demand. Even with the rising cost of healthcare in Bangkok, it is still around 60% lower than those in Singapore.

All of this may sound overwhelming for Singapore locals, but an increased cost of living has also spurred the country’s government to take action to support the needs of citizens. Recently, the government has announced an increase in its Assistance Package, which provides cash payments to eligible adults in the region.

Moreover, the government unveiled plans for an expansive relief package for citizens struggling to cope with the economy, including a $1.1 billion Cost-of-Living support package. With these additional support options, as well as a streamlined digital lending sector, Singapore residents can look forward to significant relief for their financial woes.

In Thailand, governing officials have also announced in April plans for nearly $14 billion in economic relief through cash payments, which residents can expect to receive within the coming months.

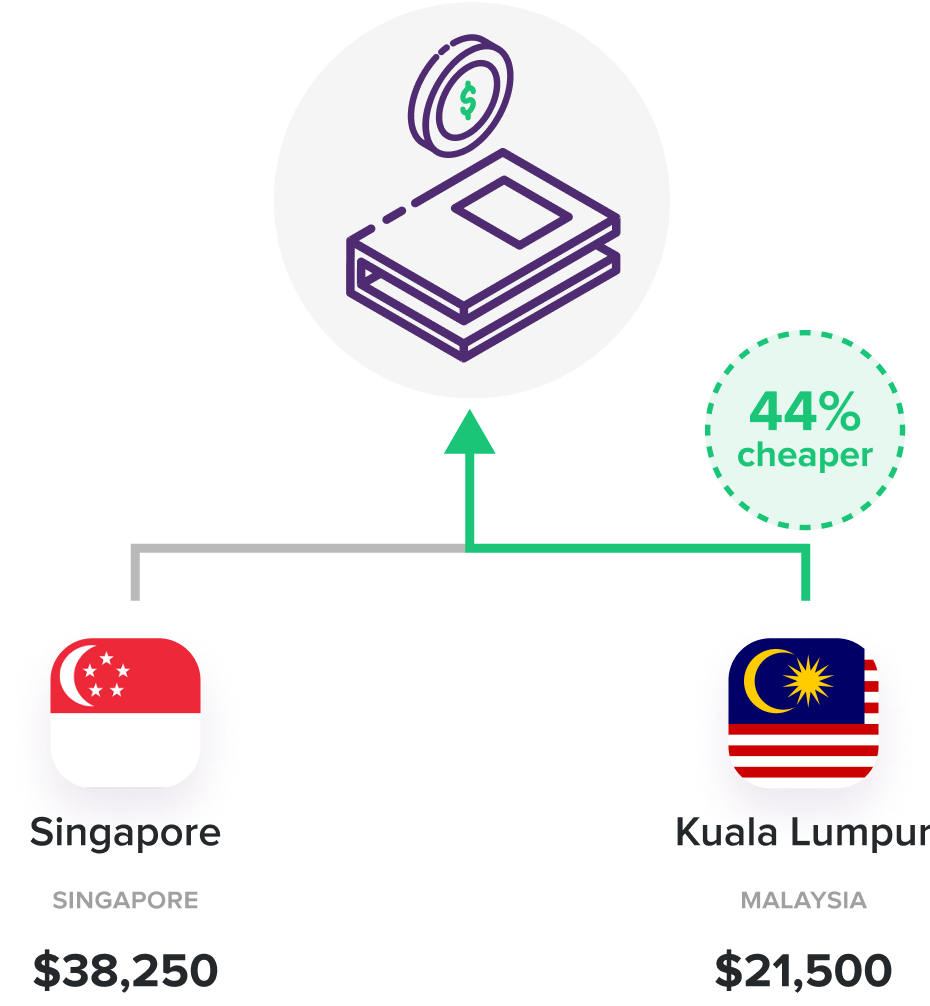

As more families move to Singapore from the mainland, the demand for higher education services is also expected to increase. Since the country enjoys low unemployment rates and a higher-than-average salary range, having access to quality education is essential for citizens looking to improve their quality of life.

In the past 20 years, the cost of receiving a higher education in Singapore has increased by nearly 74.7%, leading to an inflation rate of approximately 2.83% each year. Today, the average cost of a four-year college program in Singapore is estimated at $38,250. Of course, this does not include student aid and scholarship programs, which help young citizens offset these costs.

As we’ve mentioned, Singapore’s island location makes it more challenging to keep up with the demand for resources, especially food and household items. This issue has been exasperated by global supply chain issues that have continued to plague the international marketplace since the pandemic.

For example, more than 90% of Singapore’s food supply, including clean, drinkable water, is imported from external sources. Government officials are seeking to control these rising costs by maintaining strong relationships with neighbouring nations like Malaysia. However, the impact of global shortages on Singapore’s cost of living can not be understated.

Another country impacted by this is the Philippines. In 2023, the country reported a stiff increase in costs for outsourced materials like school and office supplies, rising by nearly 16% from the previous year.

DISCLAIMER

This information herein is published by ROSHI Pte Ltd (UEN 202222480E) (“ROSHI”) and is for information only. This publication is intended for ROSHI and its clients to whom it has been delivered.

This report contains aggregated insights derived from various public sources including:

The analysis aims to provide perspectives on cost of living developments and trends in Singapore and South East Asia but may be incomplete or condensed. ROSHI makes no warranty to accuracy or assumes any responsibility for decisions made based on this report. Figures used are for illustration and do not bind ROSHI. ROSHI performs marketing and matchmaking services to connect clients with lending partners but does not directly offer any lending or financial advisory services under regulation by the Monetary Authority of Singapore. Users of this report should consult professional advisors before engaging in any transaction. This report is meant solely for insight purposes following Singapore laws and regulations around data privacy. Please contact ROSHI for authorization before reproducing or relying on the analysis.