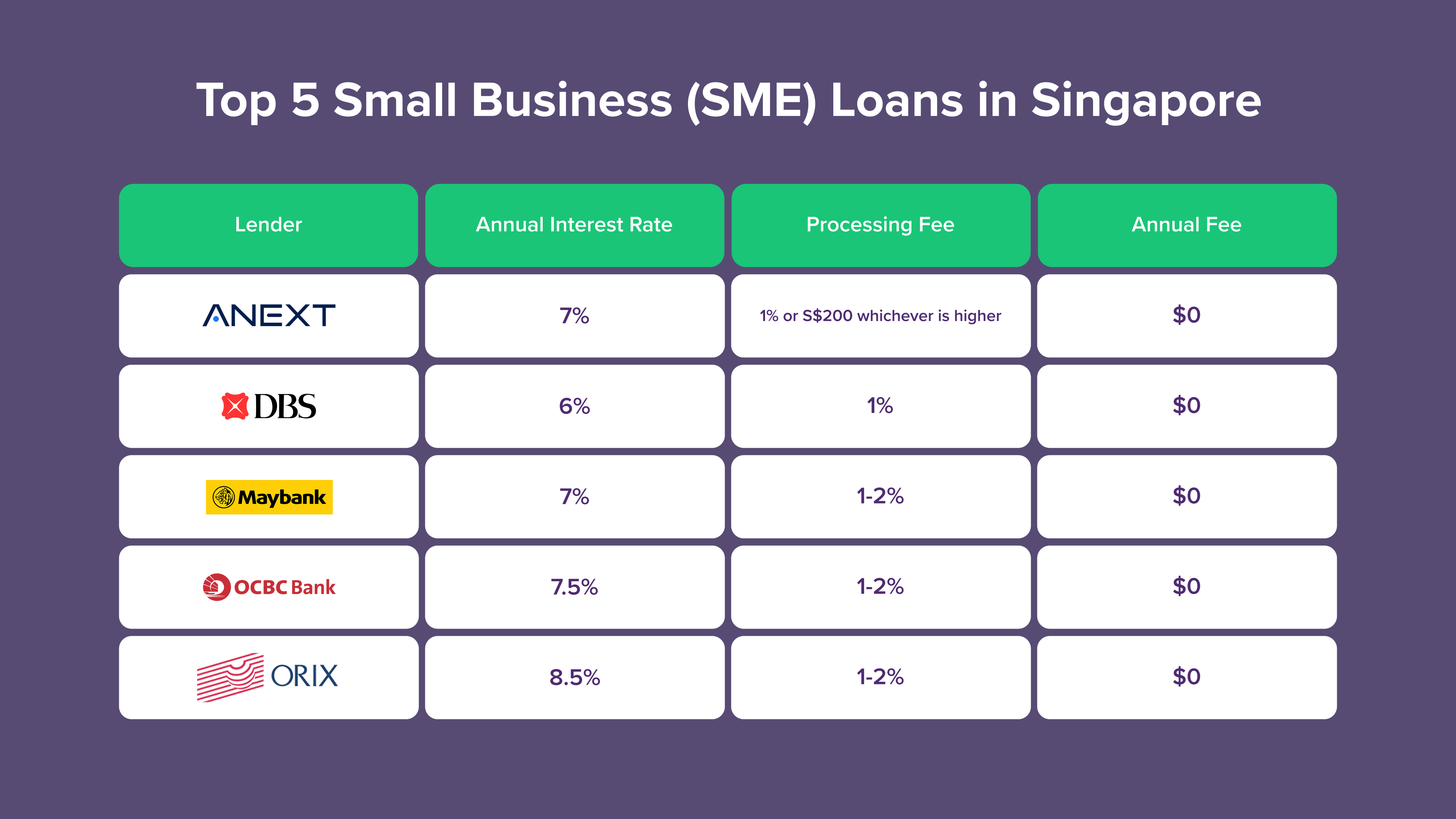

At a glance

Navigating business financing in Singapore can be overwhelming, especially for small enterprises seeking flexible, fast-access funding. Whether you’re launching a startup or scaling operations, securing the right small business loan is critical. From digital lenders like Anext Bank to established players such as DBS, Maybank, OCBC and Orix, the market offers a wide array of financing solutions tailored for SMEs.

Each lender provides varying terms in interest rates, processing fees and repayment schedules, making it vital to assess what works best for your business cash flow. This article compares five of the most competitive loan options currently available, highlighting key features to help you make an informed financing decision.

Continue reading to explore which business loan best aligns with your company’s growth goals, operational needs and financial resilience.

Exploring the Most Popular Business Loan Solutions in Singapore

Before diving into the top business loan offerings for SMEs, it’s important to understand the common types of business financing available in Singapore. Whether you’re seeking capital to scale operations, manage daily expenses or fund a new venture, different loan types cater to different business stages and needs. Below are five fundamental business loan options that small business owners should consider.

1. Standard Business Term Loan

A business term loan remains one of the most accessible and reliable financing options for small and medium‑sized enterprises (SMEs) in Singapore. Offered through traditional banks and licensed financial institutions, this loan provides a lump‑sum amount that is repaid over a predetermined period, typically lasting from one to five years. These facilities are generally unsecured, which means no physical assets or property need to be pledged as collateral – a feature that appeals to businesses seeking adaptable working capital solutions.

Funds from a term loan can be used for various business purposes such as purchasing inventory, hiring staff, upgrading technology systems or expanding office space. Interest rates differ according to a company’s credit profile and financial stability, making this loan most suitable for businesses with a consistent income record and complete financial documentation.

By providing predictable repayment schedules and flexible usage terms, business term loans help entrepreneurs manage cash flow, plan investments effectively and sustain growth across different economic cycles.

2. SME Working Capital Loan (WCL)

The SME Working Capital Loan, part of Singapore’s government-backed Enterprise Financing Scheme, is designed to support locally owned small and medium enterprises (SMEs). It allows eligible businesses to borrow up to S$1 million, with loan tenures ranging from one to five years.

To qualify, your company must be registered and operating in Singapore with at least 30% local (Singaporean or PR) ownership. What makes this loan particularly appealing is that the Singapore Government co-shares the risk with participating banks. This reduces the financial institution’s exposure, enabling them to offer lower interest rates than standard commercial loans.

For SMEs facing cash flow constraints or gearing up for a business pivot, this scheme offers a timely and supportive solution.

3. Temporary Bridging Loan Programe (TBLP)

Initially introduced in response to the economic impact of the COVID-19 pandemic, the Temporary Bridging Loan Programme (TBLP) remains active to help businesses manage liquidity and maintain operations amid ongoing uncertainties.

Under this scheme, eligible companies can access up to S$5 million, repayable over a tenure of one to five years. Like the WCL, the TBLP is backed by Enterprise Singapore and requires a minimum of 30% local shareholding. It’s especially useful for businesses that need short-to-mid-term capital for operational continuity, overseas expansion or upgrading initiatives.

Although interest subsidies are gradually being phased out, the TBLP still offers one of the most competitive financing options in the market for eligible SMEs.

4. Startup Business Loan

For early‑stage entrepreneurs and new businesses in Singapore with limited operating history, obtaining credit from traditional banks can be challenging. Startup business loans are specifically designed to bridge this gap, providing capital to micro‑enterprises and young startups that have typically been in operation for less than two years.

Loan amounts usually extend up to S$100,000 and these loans often do not require physical collateral. However, lenders commonly evaluate the applicant’s business plan, future cash‑flow projections and sometimes the founder’s personal credit score or income stability to determine eligibility.

This type of financing works well for home‑based ventures, retail stores and digital startups that need funds for working capital, marketing activities or initial inventory purchases. While interest rates can be slightly higher due to the perceived lending risk, the flexibility and ease of access make startup loans a valuable foundation for scaling new enterprises.

By supporting business owners at the critical early stage, startup loans help entrepreneurs establish financial credibility, manage capital efficiently and accelerate the transition from concept to sustainable growth.

5. Business Loan from Licensed Moneylenders

When bank loan requirements become too stringent or immediate funding is critical, licensed moneylenders in Singapore offer a fast and legally regulated alternative. Operating under the oversight of the Ministry of Law (MinLaw), these lenders provide business loans with simplified eligibility criteria and accelerated approval processes, making them suitable for companies that need urgent financing or have limited credit history.

Loan tenures are generally shorter and interest rates range between 1% and 4% per month, depending on the borrower’s risk profile. While these rates are higher than those charged by traditional banks, processing speeds are significantly faster, with funds often disbursed within 24 to 72 hours. This accessibility makes such loans appealing to startups, SMEs or businesses with poor credit that face temporary cash‑flow challenges.

These loans are most effective for short‑term financial requirements, urgent expenses or temporary working capital shortfalls. However, exercising proper due diligence is crucial. Always compare multiple lenders, examine loan agreements carefully and ensure that the repayment schedule matches your business’s cash‑flow capabilities.

Partnering exclusively with licensed moneylenders regulated by Singapore’s Ministry of Law (MinLaw) helps business owners avoid unregulated practices and maintain both legal compliance and financial stability. This cautious approach strengthens a company’s overall credit health and supports sustainable access to future financing opportunities.

Top 5 Small Business Loans in Singapore

1. ANEXT Business Loan

ANEXT offers an accessible-term loan with a competitive annual interest rate of 7%, making it a reasonable choice for small businesses seeking straightforward financing. The lending comes with a 1% processing fee or a flat S$200, whichever is higher and there is no annual fee. For a typical borrowing scenario, the monthly repayment works out to approximately S$2,970.18.

ANEXT Business Loan

This offer is ideal for businesses looking for transparency in fees and predictable repayment schedules. While ANEXT is not a bank, its simplified criteria and clear cost structure make it a practical alternative for companies that want swift processing without complex collateral or equity requirements. Entrepreneurs can forecast cashflow comfortably, as all major liabilities are transparent upfront, reducing financial uncertainty in the early stages of borrowing.

2. DBS SME Working Capital / Business Term Loan

Backed by Enterprise Singapore, DBS’s SME financing schemes combine affordability with digital efficiency. These loans generally carry an annual interest rate of about 6%, a 1% processing fee and no annual maintenance costs. Under a typical arrangement, the monthly repayment is around S$2,899.92, which positions DBS among the more cost‑competitive lenders in the SME segment.

DBS SME Working Capital / Business Term Loan

Businesses can apply conveniently through MyInfo Business or Singpass and new applicants requesting up to S$50,000 usually need only minimal documentation. As a financial institution regulated by the Monetary Authority of Singapore (MAS) and supported by Enterprise Singapore’s government‑backed programs, DBS offers loans of up to S$500,000 to fund day‑to‑day operations or business expansion efforts.

Beyond affordability, DBS distinguishes itself through its digital infrastructure. Repayment plans are simple to understand, fees are clearly outlined and applications are processed quickly via online tools designed specifically for SMEs. This makes DBS a reliable choice for business owners seeking transparent terms, trusted governance and seamless loan management.

3. Maybank Business Term Loan

Maybank’s business financing solutions provide term loans tailored to the funding needs of small and medium‑sized enterprises (SMEs) in Singapore. These loans feature an annual interest rate of around 7%, a processing fee between 1% and 2% and no annual maintenance charges. With estimated monthly repayments of about S$2,970.18, the cost structure remains competitive with digital lenders like ANEXT, though specific terms may vary based on the applicant’s business profile and credit standing.

Maybank Business Term Loan

Through the Online Business Financing platform, SMEs can apply using MyInfo or ACRA‑verified business records, streamlining the documentation process. Existing Maybank customers seeking up to S$150,000 can often obtain same‑day or next‑day approvals without the need for collateral or formal financial statements, simplifying loan access for growing enterprises.

Maybank is particularly well‑suited for small businesses that prioritize speed, convenience and established banking relationships. This option is ideal for companies seeking working capital or early‑stage expansion funds without extensive credit histories or pledged assets. Its combination of fast processing and flexible eligibility makes it a dependable choice for SMEs managing cash‑flow cycles or scaling operations efficiently.

4. OCBC Business Loan

OCBC Bank offers a business term loan tailored to meet the funding needs of small and medium‑sized enterprises (SMEs) and startups in Singapore. The loan features an annual interest rate of about 7.5%, a processing fee between 1% and 2% and no recurring annual charge. Estimated monthly repayments average around S$3,005.69, which may be slightly higher than some competitors, yet OCBC distinguishes itself with its financial stability and flexible lending approach.

The bank provides several financing options, including the SME Working Capital Loan, a government‑backed facility offering up to S$500,000 and the Business First Loan, designed specifically for startups operating under two years. Eligible applicants for the latter may access funding of up to S$100,000 with minimal documentation and quick approval processes, ensuring greater accessibility for young enterprises seeking early‑stage capital.

As one of Singapore’s oldest and most reputable banks, OCBC also promotes sustainable finance initiatives such as Sustainability‑Linked Loans, developed in partnership with Enterprise Singapore. These programs provide added value for ESG‑driven SMEs, enabling them to align their financing strategies with sustainable business practices and long‑term environmental impact goals.

5. Orix SME Loan

ORIX Leasing Singapore, in collaboration with Enterprise Singapore, provides SME financing solutions such as working capital and fixed‑asset loans tailored to the needs of growing businesses. The loan carries an annual interest rate of about 8.5%, a processing fee between 1% and 2% and no annual maintenance charges. On a typical repayment schedule, monthly instalments average S$3,077.48, offering transparent cost expectations for applicants.

ORIX’s financing portfolio primarily serves companies seeking capital for automation, machinery upgrades, fleet expansion or property investments. With loan amounts available up to S$30 million and repayment terms of up to 15 years, the program supports both near‑term liquidity and long‑term capital investment. The inclusion of 50% enterprise risk‑sharing through Enterprise Singapore makes this option especially suitable for locally owned SMEs that meet structured eligibility criteria and wish to expand without over‑leveraging.

Borrowers benefit from specialized asset‑based financing that generally does not require personal guarantees, enabling SMEs to develop physical infrastructure while enjoying flexible repayment timelines extending beyond conventional one‑to‑five‑year loan frameworks. This combination of scale, support and security positions ORIX as a strategic financing partner for capital‑intensive industries in Singapore.

Alternative Lending Options: P2P Lending Platforms

When traditional bank loans cannot meet business needs due to lengthy approval procedures or strict credit criteria, peer‑to‑peer (P2P) lending serves as a strong alternative for small business owners in Singapore. These platforms provide faster access to capital, reduce administrative delays and deliver customized financing solutions that align with each business’s cash‑flow demands and growth goals.

Through P2P networks, SMEs can connect directly with individual and institutional investors, bypassing conventional banking restrictions while still operating within a regulated lending framework. This model promotes greater financial inclusion, enabling startups and smaller enterprises to secure the funds needed for expansion, inventory purchases or working capital within shorter timeframes.

Below are two of the leading P2P lending providers in Singapore that have earned strong reputations for reliability, transparent operations and tailored SME financing solutions.

6. Validus P2P Lending

Validus is one of Singapore’s most prominent SME-focused P2P lenders, combining fintech innovation with institutional-grade underwriting to provide business loans tailored to growth-stage enterprises. Their lending platform connects SMEs directly with accredited investors, offering a faster route to funding than most conventional banks.

Validus P2P Lending

One of Validus’ key advantages is its competitive annual interest rate of just 1.3%, significantly lower than many non-bank lenders. Borrowers benefit from zero annual fees, while processing charges range from 2.5% to 5%, depending on the loan amount and risk profile. For a typical loan, businesses can expect a monthly repayment of around $2,583.48, allowing for smoother cash flow planning.

Validus distinguishes itself through its robust credit assessment engine, which integrates alternative data points such as invoice history and supply chain metrics. This results in faster approvals and greater inclusivity for younger businesses with limited credit histories.

Moreover, Validus provides financing options such as invoice financing, working capital loans and purchase order funding, making it a full-suite lending solution for SMEs across various industries. Its user-friendly platform, real-time application tracking and data-driven insights make it an optimal choice for entrepreneurs seeking flexible and responsible borrowing.

7. Funding Societies P2P Lending

Funding Societies has established itself as one of Singapore’s leading P2P lending platforms, transforming SME financing across Southeast Asia. Focused on bridging the funding gap for underserved businesses, the platform provides fast, flexible and accessible loans that bypass the bureaucratic processes often associated with traditional banks.

Funding Societies P2P Lending

The company offers small business loans with annual interest rates starting at 1.65% and an estimated monthly repayment of about S$2,606.26, maintaining competitiveness even next to bank‑backed alternatives. Processing fees typically range between 3% and 8%, with no annual maintenance fees, ensuring cost transparency and predictability for business owners.

The strength of Funding Societies lies in its AI‑driven credit assessment system, which evaluates both traditional credit information and alternative financial metrics such as transaction behavior and cash‑flow performance. This intelligent technology supports swift loan approvals, typically within 24 to 48 hours, allowing businesses that might not meet the criteria for conventional bank loans to gain timely access to financing.

The platform supports a diverse suite of financing products, including term loans, invoice financing and micro‑loans, allowing entrepreneurs to match funding types with their specific operational needs. Its digital‑first ecosystem integrates e‑KYC onboarding, automated repayments and real‑time loan tracking, delivering an efficient and frictionless experience for SMEs.

For startups and small businesses seeking to scale without exchanging equity or pledging collateral, Funding Societies offers a powerful financing alternative. It balances innovation, speed and accessibility, enabling companies to strengthen their cash‑flow resilience and sustain growth in Singapore’s evolving digital economy.

Latest Small Business Loan Rates

The following table outlines the most up-to-date SME business loan offerings from banks and lenders in Singapore. Featured rates and terms represent real-time market data across various financial institutions. These financing solutions are designed to address diverse business needs, from expansion capital to cash flow management, with final approval terms varying based on company profile and creditworthiness.

Consideration

Before taking on a small business loan, it is vital to ensure that the chosen financing solution aligns with your operational objectives, cash‑flow capacity and repayment timeline. Different lenders, such as digital banks like Anext or traditional institutions including DBS, Maybank, OCBC and Orix, offer varying terms related to interest rates, processing fees and qualification requirements.

Interest rates commonly range between 6% and 8.5% per year and while monthly repayments might appear manageable, additional costs such as processing fees, administrative charges or early repayment penalties can increase the total borrowing expense. SMEs should assess their credit history, business tenure and industry risk profile, as these factors directly influence loan approval and interest terms.

Equally important are loan tenure flexibility and funding speed, especially for businesses managing irregular cash‑flow cycles. Platforms like Roshi.sg enable entrepreneurs to compare multiple financing products simultaneously, allowing them to make data‑driven borrowing decisions that align with long‑term financial goals.

Above all, practicing responsible borrowing is essential. Instead of focusing solely on the lowest rate, business owners should choose a lender that provides transparent terms, scalable financing options and supportive customer engagement suitable for their stage of growth.