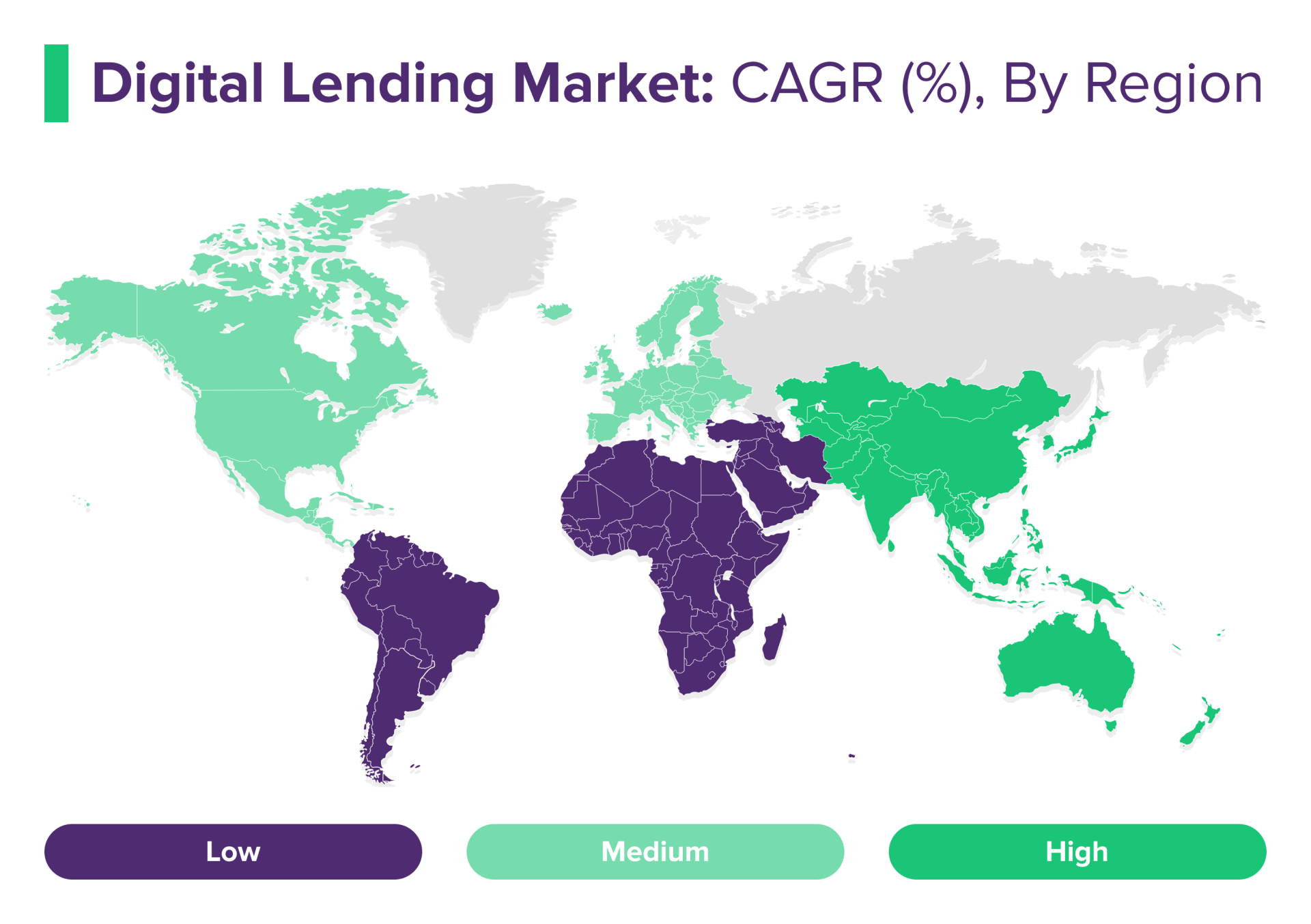

In a world where technology is reshaping nearly every industry, the finance sector is experiencing a digital revolution of its own. One area that’s changing fast and in some pretty exciting ways is digital lending. As consumers and businesses insist on faster, more convenient ways to borrow, digital lending platforms are stepping up to the challenge. But where is this all headed? What trends will define the future of lending?

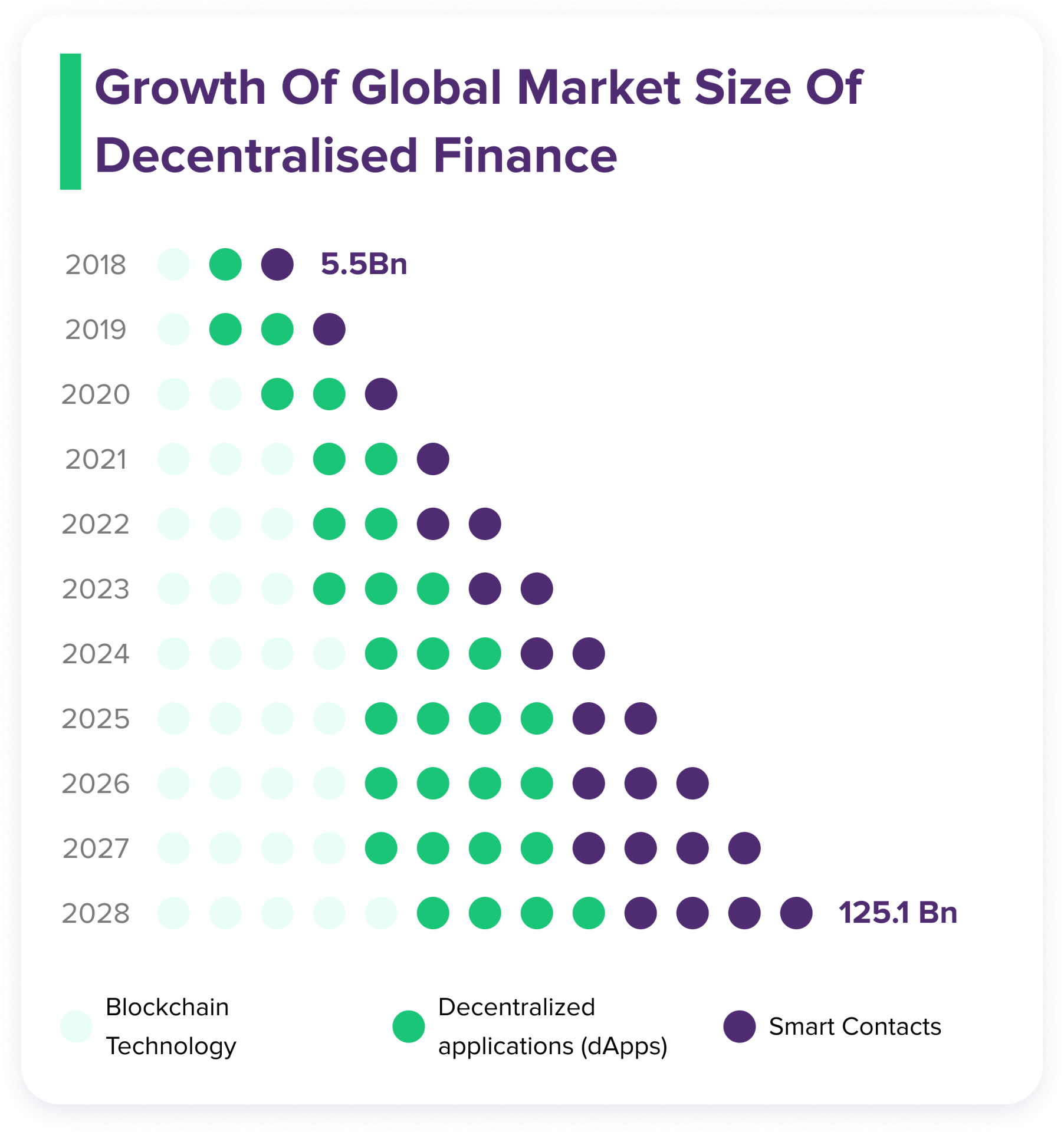

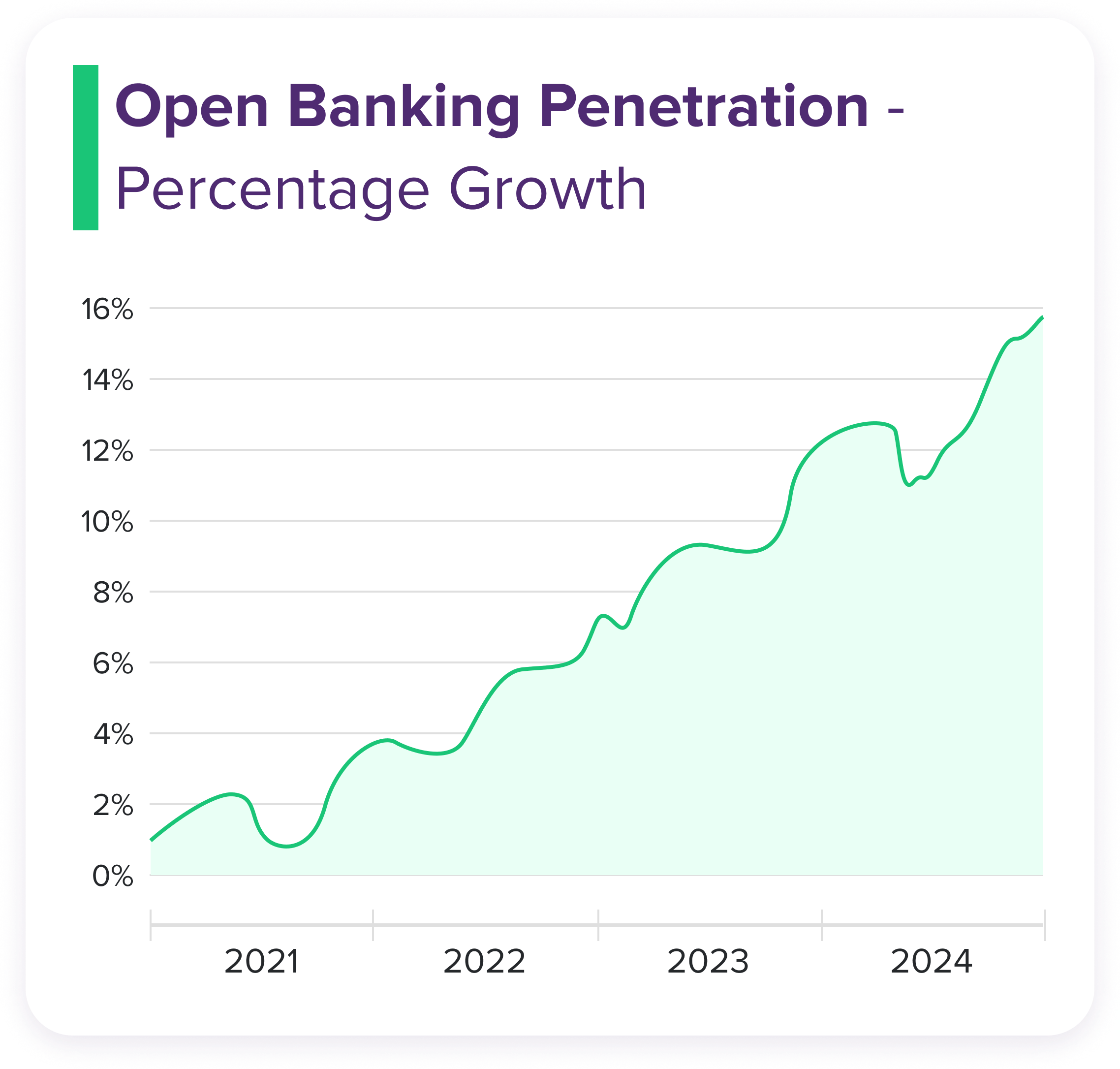

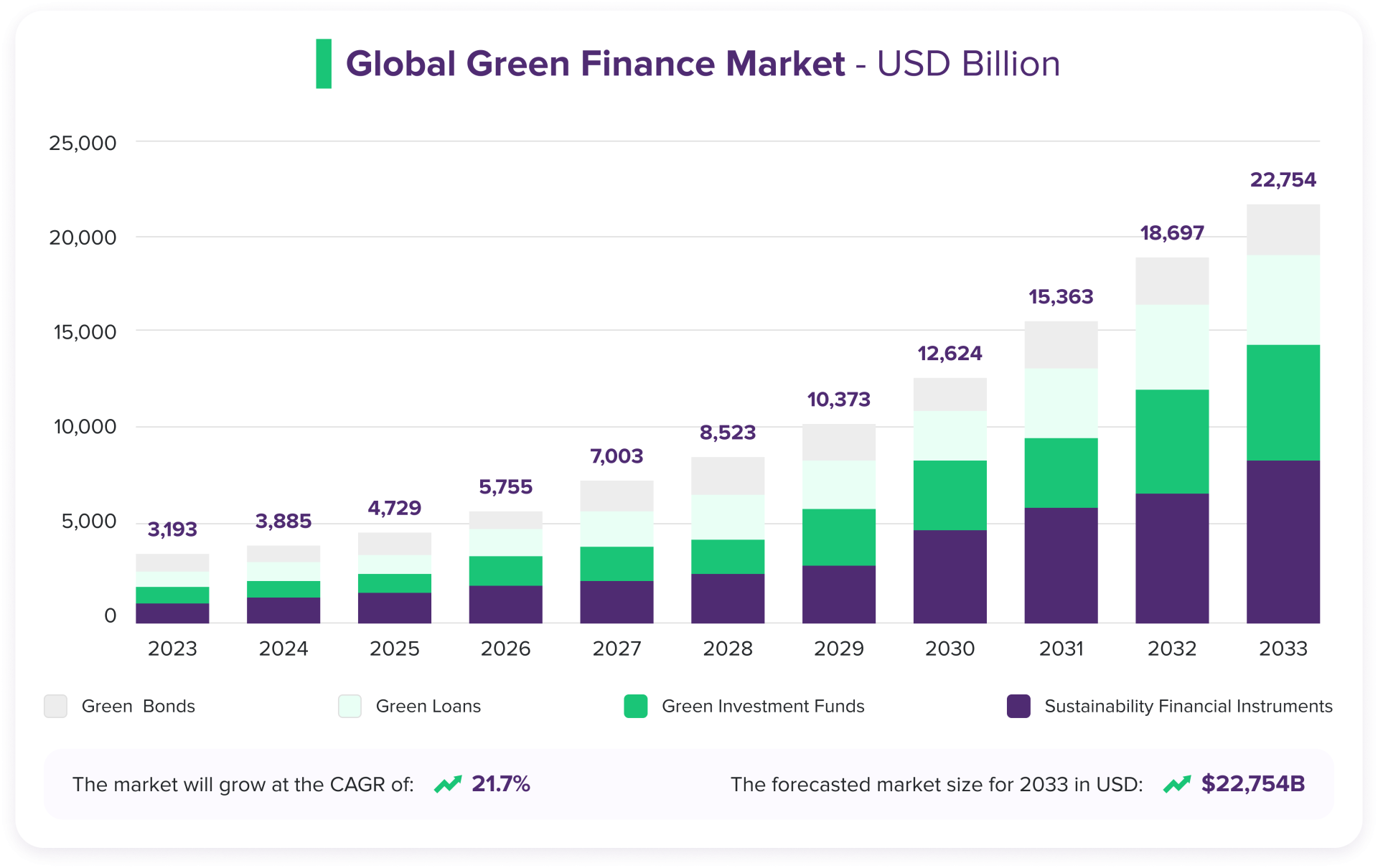

In this latest ROSHI report we explore the key shifts occurring in the digital lending sector from the rise of artificial intelligence to the role of decentralised finance. We look at what this means for borrowers, lenders and even the regulators trying to keep up with this fast-moving environment.